Digital musculoskeletal care firm Hinge Health, went public right now on the NYSE beneath the image HNGE, elevating round $437.3 million with its preliminary public providing, which offered 9.14 million shares.

The San Francisco-based firm, based in 2014, presents sufferers with musculoskeletal situations entry to well being coaches, orthopedic surgeons, bodily therapists and technological assets, akin to surgical procedure choice assist.

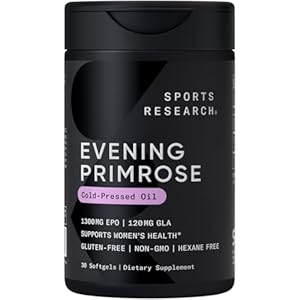

Hinge additionally presents its FDA-cleared wearable Enso, which gives electrical pulses to alleviate on a regular basis ache, and a pelvic women’s health program.

The corporate, which is among the most outstanding gamers within the digital musculoskeletal care area, opened on the NYSE at a stock price of $39.25 per share, which was 23% increased than its initially anticipated IPO value of $32. The corporate’s inventory closed at $37.56 per share on its first day of buying and selling.

THE LARGER TREND

Hinge introduced its plans to go public in 2022, a yr after elevating $300 million in Series D funding and $400 million in a Series E round.

The corporate filed for an IPO in March with the U.S. Securities and Change Fee (SEC).

On the time of its IPO filing, the corporate mentioned it had greater than 50 companions as of the top of 2024, with a majority of its shoppers contracted via giant nationwide or regional well being plans and different companions which might be giant nationwide PBMs.

The corporate has introduced quite a few partnerships over the past two years, together with an expanded partnership with digital care firm Teladoc, a collaboration with Amazon Health Services, a partnership with ladies’s well being digital care specialist Midi Health, and a collaboration with worker and authorities advantages group Sun Life.

Trending Merchandise